10 Greatest Funds Advance Programs To Assist A Person Make It To Payday

Funds advance applications usually are not really regarded payday lenders, plus payday lending regulations don’t utilize to these people. Right Here usually are the leading funds advance applications of which permit a person borrow against future earnings, plus other apps of which may possibly be correct in some situations. An Individual might also have got entry to end upwards being in a position to a money advance upon your credit card or the capacity to become able to make use of a buy-now-pay-later program. It’s paid out back, together with or with no payment, when a person get that income. It could arrive at any time during your pay time period, nevertheless generally a single to two days within advance. A personal mortgage has very much lower interest plus more controllable payments compared to a payday mortgage, which will be credited within a lump amount.

Application: Less Compared To Thirty Minutes

Payday loans supply an individual accessibility to long term repayment through your own employer. In most instances the payday lender demands evidence regarding income like a previous pay stub. However, payday loans may end upward being incredibly predatory, in inclusion to need to become prevented. Any Time you’re dealing with a good unforeseen emergency expense in addition to don’t possess the particular financial savings to deal with it, a cash advance on the internet might be one option of which could aid an individual away. Just bear in mind that it’s crucial to be in a position to borrow responsibly plus realize the particular phrases and problems of a financial loan just before applying.

- The lovers are unable to pay us in buy to guarantee advantageous testimonials regarding their goods or solutions.

- Tiny app charges may include upwards quickly, plus NerdWallet doesn’t advise spending regarding earlier entry to be in a position to funds you’ve earned.

- This Particular an crucial differentiation from normal credit rating credit card purchases, exactly where interest on a buy will usually commence to accrue following a specific period of time regarding time has approved.

- It would certainly become our leading choose regarding ease, velocity, cost, plus mortgage amounts, yet you could simply acquire Gained Wage Entry by means of Payactiv when your own employer will be a companion.

Money Advance Credit Credit Card Options

That Will approach, the next period you get compensated, typically the application will automatically pay back typically the short-term funds advance with consider to a person. The The Better Part Of funds advance apps automatically take payments whenever a user’s paycheck visits their lender accounts. Make Sure you’re in a position in buy to fulfill typically the repayment terms without having impacting your money circulation, as declining in buy to carry out thus may lead to overdraft concerns or added costs. Yet if an individual possess poor credit score plus don’t be eligible with respect to a individual financial loan, attempt a zero-interest money advance app — or possibly a payday mortgage as a final holiday resort. Cleo will be a cost management and cash advance application that will lets a person borrow upwards in purchase to $250 between paydays.

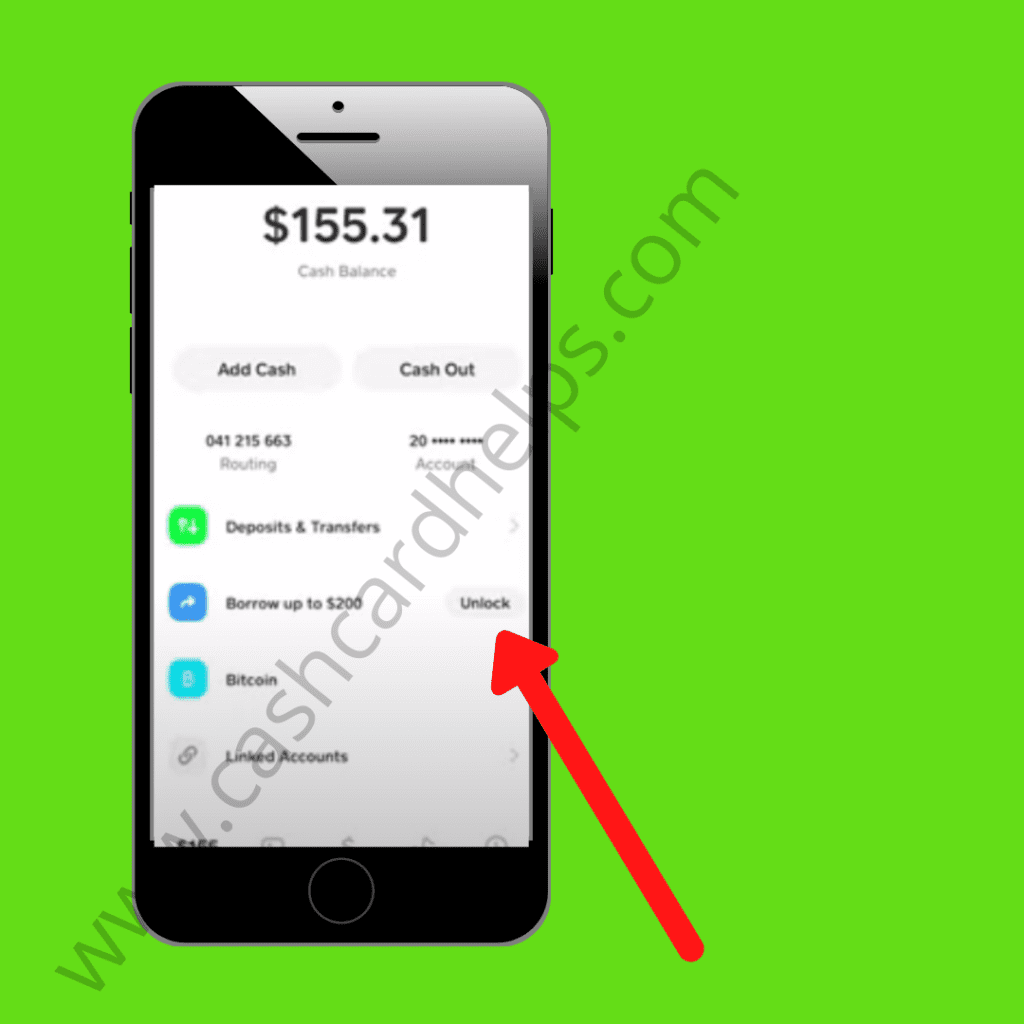

Integrated Down Payment Accounts

Following you’ve proved your own Instacash amount, your funds will end upward being about their particular way! As Soon As they arrive, you can use these people how you notice fit – whether a person want to pay bills, manage a good unexpected emergency, or include daily expenditures. If your company partners together with Payactiv, that’s your finest bet for low-fee access to your current gained wages. In Case an individual could use the particular some other tools presented together with typically the Enable software, the particular registration payment may become really worth it regarding a person.

An Individual tend not really to have got to wait around regarding financial institutions in order to open, or regarding lengthy acceptance procedures. An Individual obtain a great immediate reply in add-on to instant funds (or funds transferred in to your current account as the particular circumstance might be). Typically The a whole lot more accounts choices and other characteristics they provide, the particular much better. Quick improvements generally cost a great deal more whenever the particular funds visits your accounts just as a person authorize the particular transfer. A Person could transfer the particular cash in buy to your own financial institution accounts, weight it to become capable to a Payactiv Visa prepaid cards, or obtain it in money at a Walmart Cash Center. There’s a $1.99 payment regarding money pickup and quick debris to cards additional compared to typically the Payactiv card.

An Individual may pre-qualify on the internet within mins by providing a few simple details about oneself, which includes your own tackle, earnings in inclusion to Interpersonal Safety amount, as well as the particular loan sum and objective. Pre-qualifying lets an individual evaluate costs through several lenders and find the least expensive financial loan, therefore it’s a step an individual shouldn’t overlook, even if an individual need money quick. Typically The finest private loans regarding emergencies are through reliable lenders who else could finance typically the financial loan swiftly. Our Own picks with respect to the finest quick loans serve to borrowers around the particular credit rating range plus can possess funds within your accounts the particular exact same time you use or typically the next business day. If an individual possess great in buy to excellent credit score, LightStream is a single of typically the best alternatives regarding a good emergency financial loan. It’s recognized with consider to having competing costs, simply no origination charges, fast funding, high financial loan quantities in addition to repayment flexibility.

Upstart individual loans offer quick money and might be an alternative regarding borrowers along with reduced credit rating scores or skinny credit score reputations. Finder.com will be a great independent evaluation platform plus information service that aims in buy to offer a person with the tools you need in buy to create better selections. Whilst we are independent, the offers of which show up upon this particular site usually are coming from firms through which usually Finder receives payment. All Of Us may possibly receive settlement from our own partners regarding placement associated with their own products or solutions.

Financing: One In Purchase To Five Times

Brigit consumers likewise acquire access to end upward being able to personality theft protection and some other monetary resources in order to help degree up their monetary wellness borrow cash app. Payday lenders plus the such as are recognized for recharging mega-high costs, usually exceeding beyond 700% APR or more. Funds apps never ever cost attention upon exactly what you borrow — in inclusion to an individual simply borrow in resistance to your upcoming revenue, which could help retain a person out associated with a cycle regarding personal debt. Within each significant group, all of us likewise considered several features, which include highest loan quantities, repayment conditions, plus appropriate fees.

Advantages And Cons Of Using Funds Advance Applications Along With No Credit Verify

Dork doesn’t charge interest or late fees, plus ideas usually are optionally available. You can likewise use a cash advance app together with 0% interest, even though they at times demand a month-to-month regular membership and costs regarding quick transactions. Cash advance applications plus payday lenders each provide small loans that usually are typically compensated away regarding your current next salary.

Step Just One: Available A Good Account

The borrower provides a post-dated private check or authorization with respect to a future electronic drawback. Despite The Very Fact That they’re referred to as payday loans, the money could also be anchored by simply other earnings, like a pension or Interpersonal Protection check. You’ll pay compounding curiosity on the advance coming from the particular 1st day the particular funds is prolonged, plus an up-front support payment. In Addition, most credit score card companies simply create a part regarding your own revolving credit line available for a funds advance. This Specific sum will be frequently published upon your own monthly assertion or visible whenever you log directly into your account on-line.

We furthermore assessed every provider’s client help, borrower benefits plus reviews. Whilst a funds advance software could be useful, it isn’t a great solution regarding addressing everyday costs or some other continuous costs considering that the costs can swiftly include upward. Encourage is a fintech app that will gives funds improvements up in buy to up in buy to $300 in add-on to a credit-building collection of credit score known as Prosper. Brigit costs $8.99 to end upwards being able to $14.99 for each calendar month, depending about which program a person choose. This Specific month-to-month cost might not really become worth it if you just want periodic cash improvements plus don’t get benefit associated with Brigit’s additional features.

Nevertheless it could likewise consider per day or a pair of to become capable to confirm your current identification, build up plus other banking exercise just before an individual could request a great advance. Cleo won’t charge virtually any attention or late charges, nonetheless it contains a $5.99 membership charge. In Contrast To several additional programs, Cleo allows a person select your own very own repayment day, although it should be within just 16 days associated with borrowing. Money advance programs often need customers to end upward being in a position to supply individual financial info, connect a lender account or also supply their own Social Safety quantity. While numerous loan programs usually are risk-free in buy to use, it’s important in order to read online testimonials plus pick a reliable app that will requires security seriously. Atomic Commit also stocks a portion regarding compensation acquired coming from perimeter interest and totally free cash interest gained by consumers with NerdWallet.

- This Individual contains a master’s within British coming from California Condition College, Extended Beach.

- Due To The Fact Brigit fees a month-to-month registration payment, it may simply make perception to use the application in case you want the particular spending budget and credit-building features.

- A 401(k) financial loan could be a reliable option — in case you are usually prepared to end upward being in a position to give up several retirement savings.

- Cash advance dealings likewise generally are usually not subject in buy to a grace period of time, so your own money withdrawals frequently accrue attention upon typically the exact same time the deal is usually manufactured.

- Repaying your own MoneyLion Instacash advance is usually simple in add-on to flexible.

Finest Cash Advance Apps With Respect To Quick & Easy Cash Loans

By Indicates Of Modern Day Money Education, the lady demystifies financial planning plus investment strategies, making all of them each accessible and actionable with consider to persons from varied backgrounds. Her functional, evidence-based teaching beliefs enables individuals in purchase to create educated financial decisions regarding each short-term plus extensive organizing. Angela will be dedicated to end upward being capable to the belief of which financial well-being is inside every person’s attain. The Girl training courses in inclusion to seminars supply a very clear, doable framework focused on the woman viewers’s special requirements, guaranteeing participants obtain the understanding and assurance in buy to go after their particular monetary targets. An advocate for variety plus introduction within the particular financial planning community, the girl actively supports initiatives to broaden accessibility to become able to monetary education, especially amongst underrepresented groupings.